Something wicked this way comes.

What this summer’s ICO slowdown tells us.

Various announcements this spring, from South Korean capital Seoul announcing it might issue its own cryptocurrency to NASDAQ announcing it was ready to become a cryptocurrency exchange, and from increased blockchain adoption to major investment banks trading Bitcoin futures, made it clear that crypto and blockchains were having a moment. Another major breakthrough was SegWit’s effects on lowering the transaction fees for Bitcoin to less than $1.

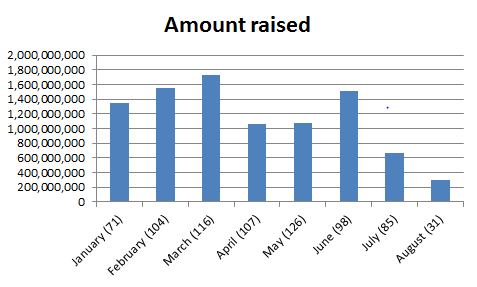

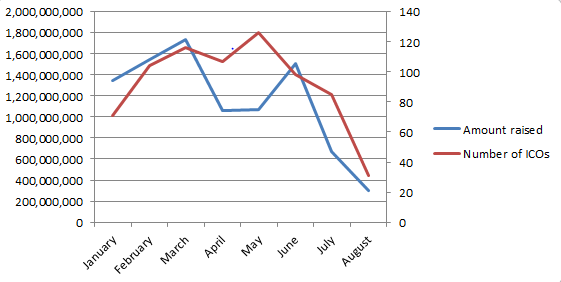

March was the absolute best in combined ICO numbers and funds raised, after which the ICO numbers remained high, while amounts slightly decreased, as can be seen in the graph below. The start of the summer season saw a severe reduction in both ICO numbers and funding, which largely corresponds to a similar downturn in 2017.

All in all, it’s been a frothy summer, with lots of love shown to blockchain technology, lots of movement on the crypto market and, for better or worse, lots of signals from regulators. The latter may be responsible for a certain wariness over the past months.

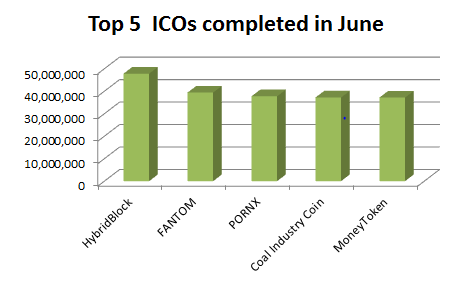

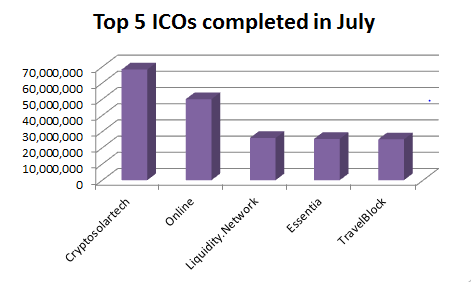

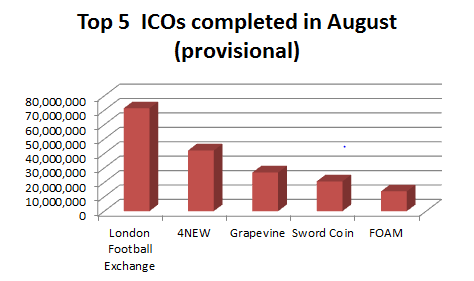

Looking at the top ICOs that have closed over the past three months, some trends are again clear. While June and July saw similar averages for the top 5 ICOs, the difference between #1 and #5 is growing, and all the more so in August, when the average also dropped.

It seems, then, that summer continues to be a challenging season, both for investors and ICO owners. What compounds the challenge, this time, is the looming threat of regulation and the ways in which the market is responding to this threat.

On the one hand, there is every sign that ICOs are growing more mature and potential investors are learning to stay away from scams. On the other hand, there are multiple signs now that, well, something wicked this way comes: maturing ICO practices are converging in a direction that may be contrary to the principle of decentralization at the heart of crypto.

Specifically, private sales are becoming a common practice among larger ICO companies, and this in turn leads to a concentration of tokens in the hands of venture capital companies. If institutional funds grow to control the market, they will also pull in the direction of stricter regulation that provides more stability and safeguards. Security tokens will become the standard, and the SEC and other regulators will no longer be able to sit this one out.