The Blockchain Brief – The week in five headlines

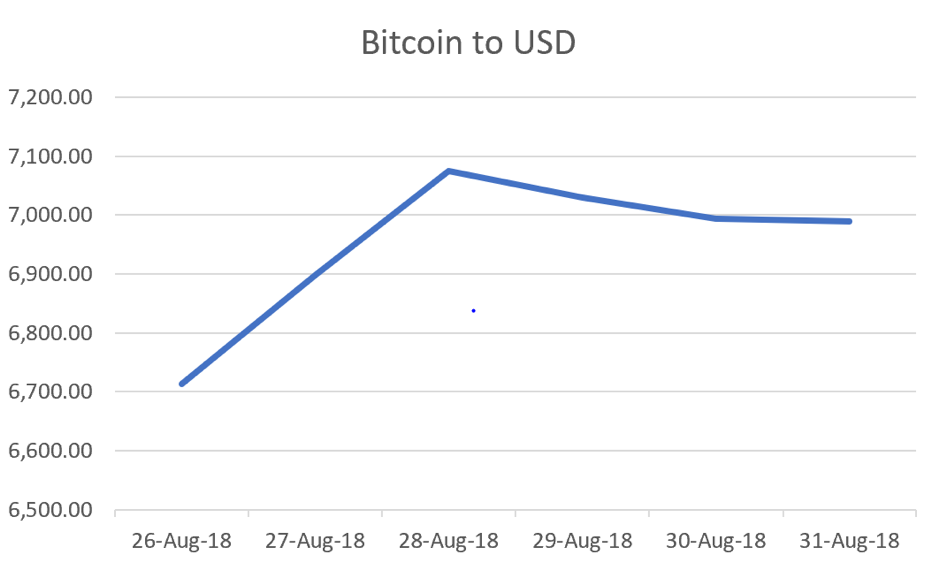

Bitcoin climbs above $7,000, then backs down, then rallies up, then…

Is it a bull? Is it a bear? Who can tell anymore?

Bitcoin started the week on a relative plateau, then went bullishly ahead to $7,100 – only to now retreat just below $7,000. It now seems to be staying put around the $7,000 mark. It’s an interesting move. As tightening regulations loom in Europe, the market is signaling it’s being conservative, but on the bullish side. With analysts estimating the current mining price in the neighborhood of $6,000, it seems unlikely the price is going to go lower than $6,500 anytime soon, despite contradictory news, threats and encouragement.

Blockchain fever is still making news

In Japan, IT Giant NTT Data announced a blockchain-based platform for trade launched in partnership with the Ministry of Economy.

Cointelegraph announces that Bank of America has applied for a blockchain-based encrypted crypto storage system patent.

US Customs and Border Protection stated they were ready to enter the proof of concept phase for their blockchain shipment tracking system.

Samsung SDS Co. unveiled a blockchain certification tool for banks. BankSign will allow people to make transactions more easily across different banks.

Civil, a blockchain journalism startup, has partnered with Associated Press to help with content distribution and license tracking.

The Organization for Economic Co-operation and Development (OECD) recently announced its Blockchain Policy Forum, a 2-day event on September 4-5. It will be broadcast live.

A national blockchain platform will be launched in Australia, in partnership with IBM and law firm Herbert Smith Freehills, “to enable Australian businesses to collaborate using blockchain-based smart legal contracts”.

California has passed a bill that calls for the establishment of a working group on blockchain technology before July 1, 2019.

Finally, Deloitte’s 2018 Global Blockchain Survey best sums up this blockchain adoption frenzy. It sees blockchain ” getting closer to its breakout moment with every passing day”.

Crypto still polarizing

As China continues its crackdown on offshore exchanges, crypto events and more, the European Union is getting ready for stricter measures. EU economic and financial affairs ministers will soon hold an informal meeting to decide on sterner attitudes and regulations on digital assets. Tax evasion, money laundering and financing terrorism via crypto are on the agenda.

Meanwhile, the eastern South Korean province of Gyeongbuk is said to be seeking to replace gift certificates issued by local authorities with its own cryptocurrency. Sources and confirmation are still shady at this point.

Also rather shady, but in a different way, is Venezuela’s attempt to peg a local crypto to oil. Reuters has uncovered how Venezuela’s president Nicolas Maduro, who has pledged 5 billion barrels of petroleum to back the countries new petro cryptocurrency, may be conducting a large-scale scam. No shops take the petro, no major cryptocurrency exchange lists it, and the oil activity supposedly backing the crypto is virtually non-existent.

In better news, that centuries-old paragon of respectability, Lloyd’s Of London, is going to provide insurance for Kingdom Trust, “a regulated financial institution offering qualified custody for digital asset investments like Bitcoin and Ethereum”.

BlockFi, a crypto-backed lending platform, was approved for operations in California, thus adding a 44th state to its portfolio.

And Yahoo is filled with crypto love. First it is going to allow cryptocurrency trading on its platform, integrating Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Bitcoin Cash (BCH) trading support on its webpage. And second, Yahoo! Japan Corporation announced it expects to launch an “easy-to-use exchange” for cryptocurrencies in the fall of this year.

If you want a taste of the dark side of crypto, here it is: a prominent Russian lawmaker (Vladimir Gutenev, first deputy head of the economic policy Committee at the State Duma) suggests gold-linked cryptocurrency as a means of avoiding U.S. sanctions and commercial dependence on the global interbanking system.

Researchers Find Discrepancies in Reported Exchange Volumes

In a find that will surprise no one, really, the Blockchain Transparency Institute reports that “ tallying up the volume numbers of the top 130 exchanges, it is estimated that over $6 billion dollars in daily trade volume is being faked with over 67% of daily volume being wash traded. ”

Binance sees huge profits

Hey, Paul Krugman. What’s the use of cryptocurrency, you ask? Well, it’s making money. In Q1 2018, Binance made a profit of about $200 million, while Nasdaq pulled in $209 million. The more interesting thing is that Binance only employed 4% of the staff.

That’s the week behind. Stay in touch – and have a good weekend!