What is a cryptocurrency exchange?

Just as with any exchange out there, a cryptocurrency exchange is a platform that intermediates financial operations. Instead of assets, cryptocurrency exchanges intermediate the buying and selling of cryptocurrencies.

When you want to trade on a cryptocurrency exchange, you first have to have money/assets there, which they hold – in other words, crypto exchanges are also crypto reserves. You then give the platform your order for a certain coin, and the order executes when the platform matches you to the buyer/seller that best fulfills your conditions, or, simply put, matches the bid with the ask; in other words, crypto exchanges are also crypto brokers.

You can place limit orders, i.e. asking the exchange to fulfill your order if your minimum or maximum price limit is met, or market orders, where you ask the exchange to just perform the transaction at the best price of the moment.

Most exchanges have an escrow system for crypto until the buyer fulfills the payment, so that there is virtually no scamming going on there (though there are other potential problems, which we’ll get to later). However, the exchange also charges you a brokering fee that can be quite significant. It can also be quite complicated to find out the amount before you actually make the transaction, since fees are often tiered, as well as buried in complicated language.

Digital asset exchanges have existed for a long time, before Bitcoin was even invented, but they tended to be seen as – or tended to be, quite honestly – marketplaces for dubious transactions. There are still bitter memories of GoldAge and Liberty Reserve, perpetrators of massive money laundering schemes.

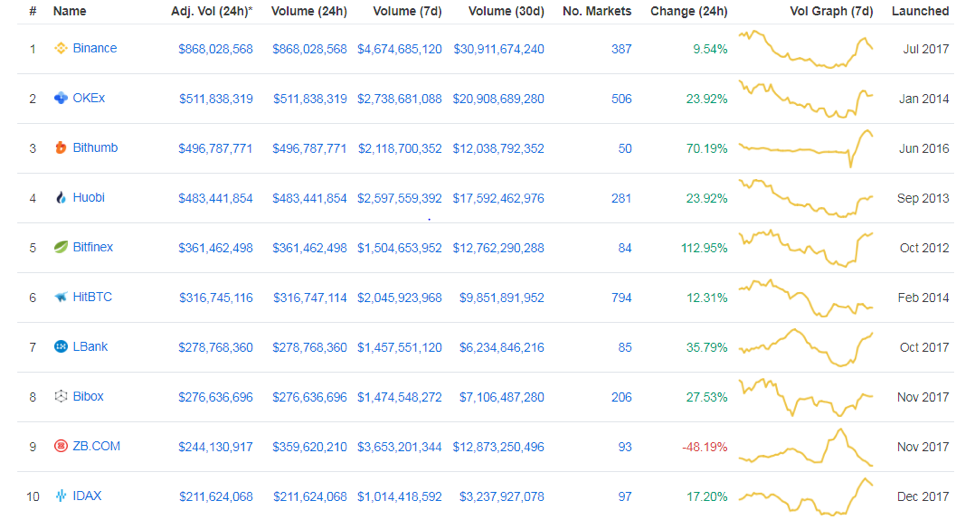

Since those early days, digital assets have evolved, and so has the world. And so have exchanges. There are now hundreds of crypto exchanges, not counting those we might think of as exchanges but which are actually brokering platforms – like Coinbase – and not counting smaller local exchanges that haven’t surfaced in international headcounts. Despite the number (somewhere between 200 and 500, depending on how you’re counting), the actual crypto trading is done massively between the top three exchanges, with the rest getting thinner and thinner figures as you go down the list.

Centralized vs decentralized exchanges

While cryptocurrency exchanges have traditionally been centralized, cryptocurrency itself prides on being decentralized. You can see how there might be a bit of a dissonance there, and in recent years the more libertarian voices in the crypto space have clamored for the decentralization of transactions. This means peer-to-peer transactions conducted without third parties like exchanges taking a cut of the money and making the transaction less secure.

With centralized exchanges, your money actually belongs to the exchange until you take it out and place it in your own wallet. You therefore allow your assets to be put at risk, either through hacking, bankruptcy or government interference.

A centralized cryptocurrency exchange will also charge you plumpish fees for transactions, which, as mentioned before, can add up to unreasonable amounts.

What a decentralized exchange does is allow users to keep their money instead of storing it in an exchange that could be hacked. Decentralized exchanges are non-custodial, simple match-making platforms that bring buyers and sellers together for much, much lower transaction fees.

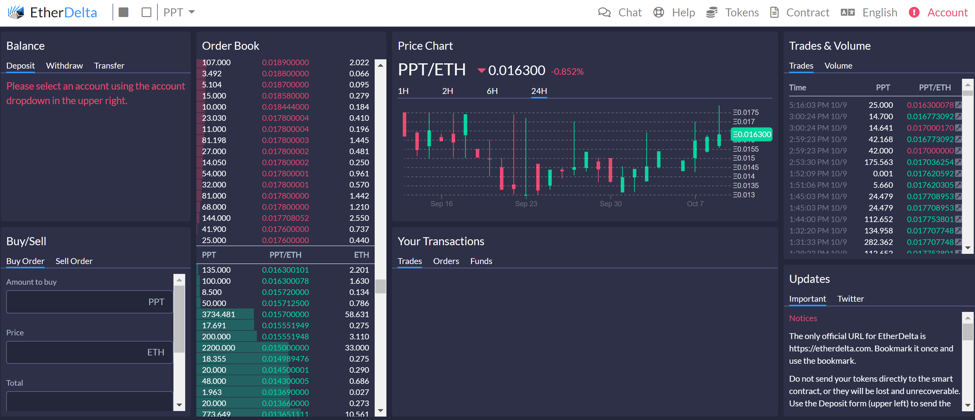

On the downside, decentralized exchanges are said to be much less user-friendly in point of both interface and ease of conducting transactions. This is partly true, depending on the type of decentralized exchange. If you go to a peer-to-peer portal like EtherDelta, you will see an interface that’s all business-centered, no frills and accessories, where you place your order and someone picks it up anonymously. This will strike most newbies as not exactly user-friendly.

On the other hand, if you go to BitShares, for instance, or OpenLedger (which is pretty much an interface built on top of BitShares, just with different order books etc.), you will get a completely different user experience that much more closely mimics the centralized exchange platforms.

What is true, though, is that the liquidity pool is much reduced in decentralized exchanges, since the volume being traded doesn’t even compare to centralized liquidity volumes. You have to do without the fat order books that are customary with centralized exchanges, showing you current buy and sell orders for millions of potential transactions. There is also no fiat currency on-ramp, virtually barring you from trading anything but crypto pairs.

Their lack of governance means less coordination of user experience and basic functionality, as well as much reduced customer support. Bottom line, it all depends on what you are looking for. If speed and low fees are important, decentralized exchanges are worth the trade-off, which is presumably why a number of centralized exchanges (Binance and Huobi among them) are building decentralized variants.

Fiat-to-crypto and crypto-to-crypto exchanges

Not all cryptocurrency exchange platforms allow all kinds of transactions. In fact, when you choose your platform, one of the first operations you should conduct is investigating what types of currency the platform supports. Fiat exchanges, for instance, allow for trading fiat currencies (USD, GBP, EUR etc.) against crypto. Crypto-to-crypto exchanges, on the other hand, only allow crypto pairs to be traded.

Even within cryptocurrency-to-cryptocurrency exchanges, there are limitations in point of the exact coins that can be traded. Some platforms that apparently offer low fees and all sorts of advantages do not, in fact, support anything other than a few coins.

What many traders do, and what you might eventually end up doing if you are contemplating trading more consistently, is open accounts with several exchanges. This will increase your chances of making gains trading, doing arbitrage or simply spreading the risk a bit thinner.

Remember, however, not to store cryptocurrency on an exchange beyond what you aim to trade within a short interval.

How to choose your exchange

You want to buy or sell crypto. There are at least a hundred options you will be confronted with, so how do you make your choice?

Remember that crypto is a much more volatile market than forex trading; your chances of making big gains or losing big are much greater here, so you’d better do your research thoroughly before you commit to one, two, three exchanges. Read the reviews with this checklist in mind:

- Is the cryptocurrency exchange legal in your country of residence? Make sure you don’t start your crypto trading by committing a felony.

- Is the platform secure? Whether a website or app, the exchange should be solid. Even if it was hacked, there is a chance its security might be better precisely because of that.

- Are exchange fees reasonable? You probably don’t want to trade $2,000 and find you’ve been deducted $200 in transaction fees.

- Is there enough liquidity on the cryptocurrency exchange? Even if you yourself do not plan to buy 10,000 Monero, just make sure the exchange has enough volume to support recurrent orders.

- Do they even support coins you want to trade? Each cryptocurrency exchange supports a limited number of currencies – frankly, it would be physically impossible to find everything in one place at this moment. Make sure they have what you’re looking for.

- Is the exchange platform you’re eyeing easy to navigate? Especially if you’re new to crypto or new to trading, this is an essential point. Can you find your account details easily, are order books easy to find, can you find the trading options you are looking for?

- Is there a decent customer support service? Reviews often give mixed ideas, but try to get a general feel for the platform. You never know when you might need customer support; make sure it’s there.

- Are there enough trading options? If you are interested in more complex trading opportunities, do your research first. Not many offer margin trading or margin funding, they offer various types of orders, from the basic market and limit orders to OCO, Fill or Kill and more.

Risks associated with cryptocurrency exchanges

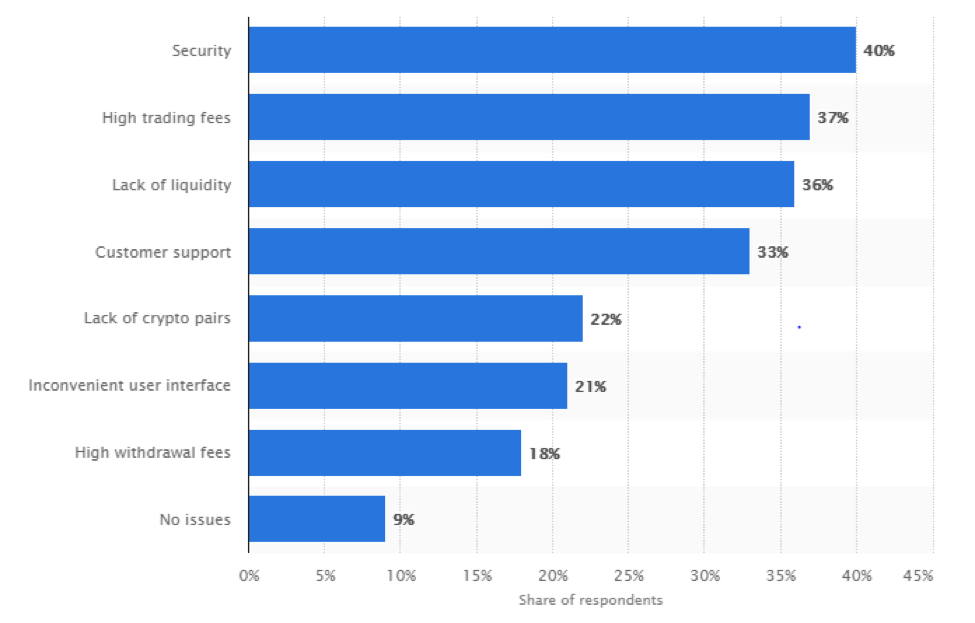

In a Statista compilation of “the biggest problems that cryptocurrency traders see in currently available exchanges”, the top spot is predictably taken by security. With so many well-publicized massive hacks, cryptocurrency exchange customers have learned to fear the worst.

Source: statista.com

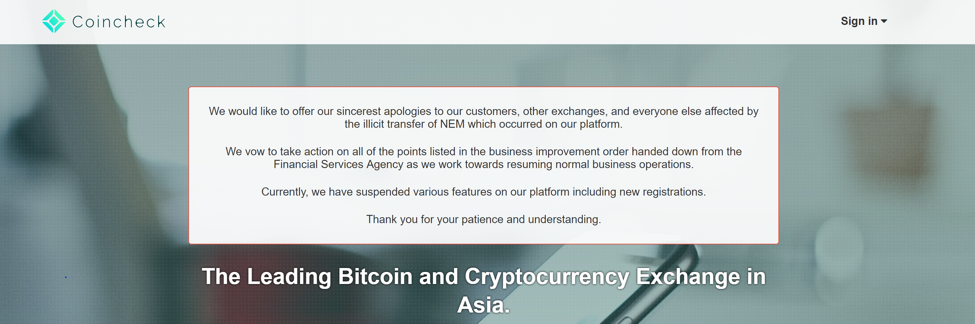

When Mt. Gox was virtually the only cryptocurrency exchange out there, its hack – which in fact took place over a long period of time – was a momentous event. Now that there are so many platforms out there, it seems that every other week there is news of this or that exchange being hacked to the tune of anything from $30 million, like Bithumb, to $500 million, like Coincheck.

Once stolen, the funds that hackers get from these exchanges remain visible – since on the blockchain every transaction is transparent – and everyone can see the wallet that holds them. With all hacks, as well as with ransom cryptocurrency, the pattern is more or less the same: the gains are laid to rest in a wallet for a while, at least for a few days, then pushed through exchanges with no KYC/AML and/or tumbler services. Eventually, they do get laundered, though the process is not easy and presents high risks for perpetrators.

There are also other problems associated with crypto exchanges, other than hacks. Wash trading and other forms of market manipulation, as well as inflated volume reporting are common accusations leveraged at even the biggest exchanges. When you choose your cryptocurrency exchange, make sure you do a bit of research; at least just google “crypto exchange name market manipulation” or “crypto exchange name fake volume”. You may not agree with the reports, but it’s best to be informed there’s a tiny possibility of fraud there.

Regulation of crypto exchanges

If you were to simplify the state of crypto regulation around the world, you could say that Europe, Australia and the Americas are largely permissive, the Far East is generally crypto-curious but leaning to the very restrictive side, with exceptions, and Russia is plain crypto-hostile. This is a very reductive manner of drawing the boundaries, but it does yield a broad-stroke picture of the crypto world.

Australia, Singapore, the European Union and South Korea have rushed this year to make their cryptocurrency exchange regulation much clearer, albeit stricter, in an effort to capture the growth of the market while halting illicit trading. China is extremely restrictive, while Japan leans to the opposite side with a much clearer framework for cryptocurrency exchange operations.

The United States have also defined jurisdiction for the SEC to supervise exchange platforms that offer trading of digital assets that are securities, which led to a rush of compliance in several US-based big shots, beginning with Coinbase and Gemini.

However, while many crypto exchange operators are preaching clearer regulation to combat volatility, cyberattacks and public mistrust, a number of cryptocurrency exchanges are practicing a very different game. Take a look at Binance, which overnight became the largest crypto exchange in the world. They moved out of China before the authorities shut down local cryptocurrency exchanges, stayed out of contentious markets and wooed friendly regulators instead. While some think you can’t be big if you don’t comply with regulations and/or you’re not in the US, Binance tells a different story: they simply advertise almost everywhere except for the United States, where they would fall under the guidance for securities trading – and its owner avoids stepping on American soil. Their game? Take over the rest of the world, and hope that the US will follow. So far, stage 1 of their long game seems to be working.

Largest cryptocurrency exchanges

Crypto exchanges are notoriously difficult to rank. Estimated volumes are unreliable, as are reported volumes (often fake, if you ask experienced cryptonomists). And yet, all current estimates seem to agree that Binance is king of the castle at the moment.

The story of how Binance rose to the top in less than a year is indeed hard to grasp in its simplicity. After a number of huge players shuffled their feet thinking about regulations, Changpeng Zhao’s Binance swept right in, shirking compliance requirements in non-friendly countries and offering a mixture of speed, liquidity and security that wooed customers around the world. The wunder-kid is now firmly in first place of the largest crypto exchanges by volume.

Source: coinmarketcap.com

Numbers, details, regulations, all that can give anyone a headache. It’s important, though, to put your right foot forward. As you prepare to step into the crypto world, exchanges are sure to be your gateway. Make sure you know how they work – and how to choose the right one for you.